According to The Sydney Morning Herald, liquidators seeking the illicit profits of fugitive corporate fraudster Michael Gu are getting ready to sue Australian casino operators Crown Resorts and Star Entertainment for as much as US$45 million.

Before he vanished in 2020, Gu claimed to be a high-flying, upscale real estate developer who owed investors in his iProsperity Group over US$245 million.

Australia's significant investor visa initiative (SIV), a government program that grants resident permits to foreign nationals willing to spend AU$5 million in domestic companies, including iProsperity as a key participant. It has proved to be one of the largest Ponzi schemes in Australia.

Large-scale fraud

According to the SMH, Gu spent more than half of the approximately US$380 million the firm raised on lavish personal loans, luxury cars, and gambling sprees.

Gu purchased a McLaren Spider, a Ferrari GTB, an Audi Q7, a Rolls Royce Wraith, and two Lamborghinis. According to court documents, he took a private jet and consumed $3,000 worth of wine.

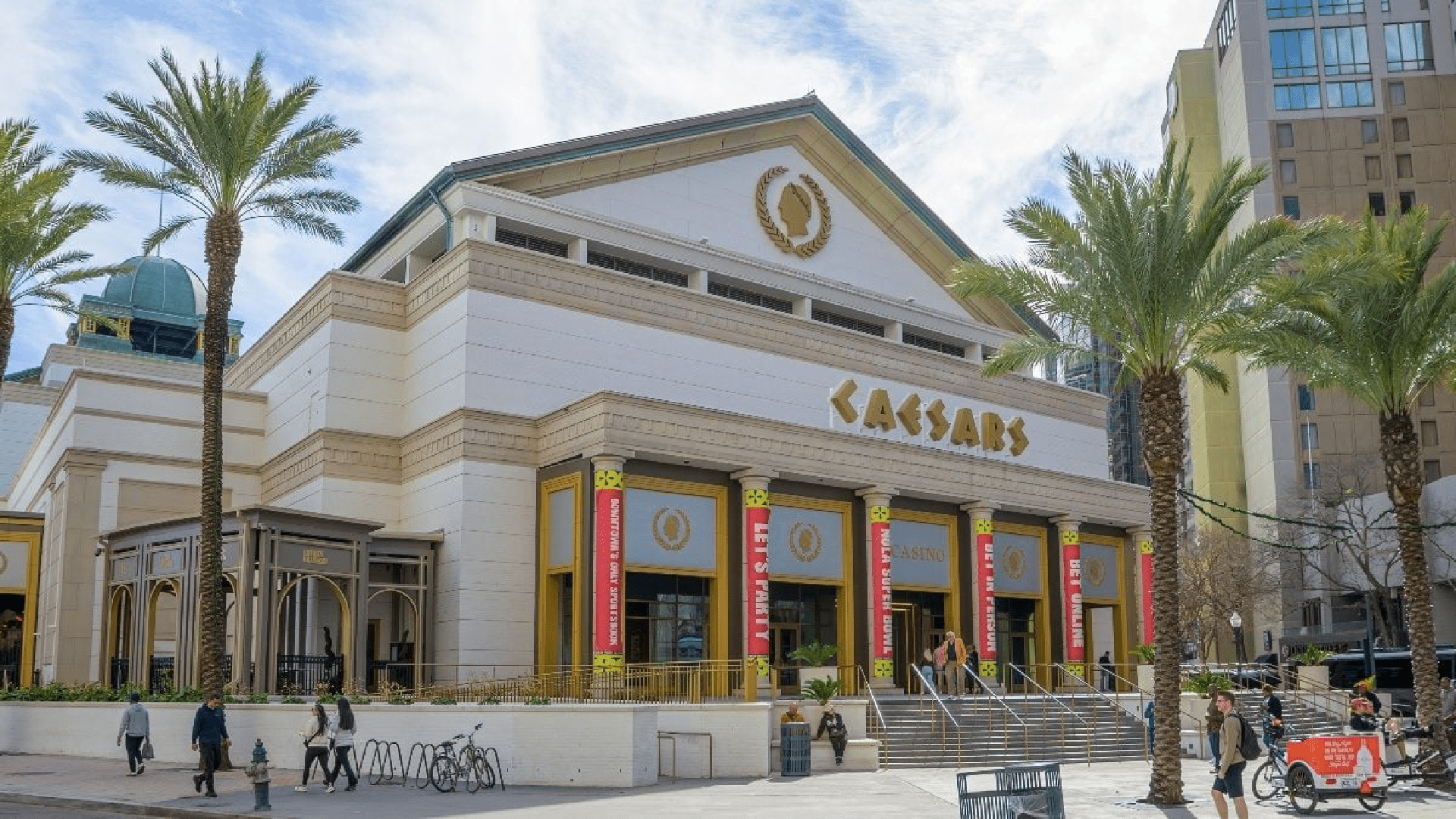

Gu and his right-hand man, Harry Huang, bet millions of dollars at the Star Sydney and Crown Melbourne prior to the company's demise, which the lawsuit will argue was the quintessential example of money laundering.

Liquidators have been searching for the money over the past four years since iProsperity's demise, looking through a complex web of sixty-four businesses connected to Gu.

They have located about US$112 million, which they are trying to recoup through civil litigation, even though much is still missing. Accounts at the two casino operators are associated with around US$45 million.

A 2022 public regulatory investigation of the Star Sydney's fitness for license prominently highlighted Gu's name. T he investigation finally determined that the operator was ineligible to hold a license due to evidence of widespread fraud and noncompliance with anti-money laundering requirements.

According to the investigation, Huang deposited a total of US$9.2 million, including US$960,000 following the demise of iProsperity, while Gu lost US$3.6 million gambling at the Star Sydney starting in 2017.

"Secret Relationship"

According to documents, Mark Walker, the senior vice president of high roller operations at the casino, "maintained a secret and longstanding relationship" with the scammer.

Gu also offered Walker a US$412,000 position managing the Casino Canberra in 2018 after Gu tried to purchase a majority share in the company from Hong Kong tycoon Tony Fung for $32 million. T he deal eventually fell short of regulatory approval.

A funding request for the litigation to recover Gu-linked funds from the two casino operators and other people and businesses associated with the scammer was granted by a federal court in the state of Victoria on Friday.

Gu's location is still unclear.

United Kingdom

United Kingdom

Germany

Germany

Finland

Finland

Norway

Norway

Canada

Canada

Ireland

Ireland