MGM Resorts International introduced a new credit card enabling customers to earn as much as 6x points and tier credits in the casino operator's rewards program on specific expenses.

In collaboration with First National Bank of Omaha (FNBO), the gaming firm announced on Wednesday the launch of the MGM Rewards Iconic World Elite Mastercard, expanding its range of cards associated with the MGM Rewards program.

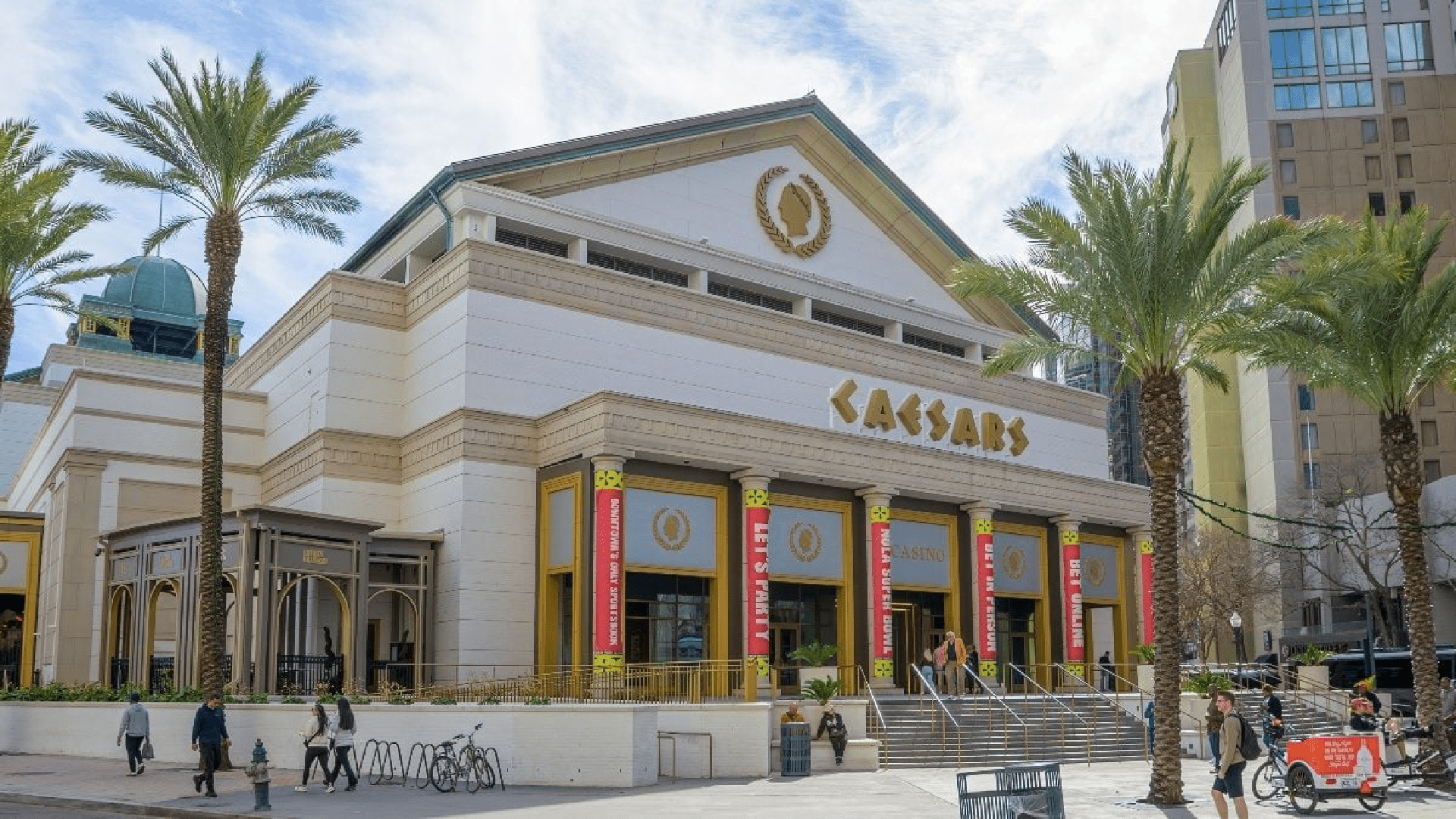

Benefits of the new card feature cardholders earning 6x points and tier credits for every $1 spent at MGM Rewards locations, including the operator’s casinos on the Las Vegas Strip. Customers are able to earn double points and tier credits at different hotels, gas stations, grocery stores, and restaurants. Such earning opportunities might be advantageous for points enthusiasts looking to advance in MGM Rewards — an endeavor that often necessitates considerable expenditure.

Sapphire represents the entry level in MGM Rewards, and to advance to Pearl status, members need to gather 20,000 tier credits. To advance to Gold, 75,000 tier credits are necessary, which is still less than half of the 200,000 needed for the Platinum tier. Membership to the Noir level is restricted to invitations only.

New MGM Credit Card Offers Additional Benefits

Besides providing one point and tier credit for each $1 spent in categories not previously mentioned, the MGM Rewards Iconic World Elite Mastercard enables cardholders to instantly achieve Pearl status if they haven't done so already.

Cardholders will receive a $200 resort credit when they open a new account, as well as each year on the anniversary of the account. Customers intending to utilize the new casino card for large purchases will receive 10,000 tier credits and a complimentary one-night stay, valued at up to $250, at MGM locations if they spend a minimum of $25,000 annually on the card.

BetMGM customers can also utilize the MGM Rewards Iconic World Elite Mastercard to accumulate one point and tier credit for every $1 deposited on the iGaming and online sports betting platform. MGM updated BetMGM’s loyalty program over three years ago, incorporating more connections to the casino rewards system.

The new MGM credit card does not consider BetMGM deposits as cash advances — a practice that many credit card companies apply to other sports betting sites — allowing customers to evade associated fees when using the card to fund their BetMGM accounts.

MGM Credit Card Is Not Inexpensive

Like many rewards credit cards, the MGM Rewards Iconic World Elite Mastercard has an annual fee. In this case, it’s $250.

Nonetheless, that seems mild compared to other yearly fees in the rewards credit sector. The American Express Platinum business and personal cards both have an annual fee of around $700, whereas the Marriott Bonvoy Brilliant American Express Card, which also has connections to MGM, is priced at $650 annually.

The Chase Sapphire Reserve card has an annual fee of $550, which is $100 higher than that of the Hilton Honors American Express Aspire card. All of those charges pale in comparison to the $5,000 annually required by American Express for the Centurion card.

United Kingdom

United Kingdom

Germany

Germany

Finland

Finland

Norway

Norway

Canada

Canada

Ireland

Ireland