Bet365 is said to be in discussions with American investment bankers about a potential sale of the gaming firm valued at $12 billion.

On Thursday, The Guardian revealed that the Coates family, which manages Bet365, has engaged in talks with Wall Street banks about a complete or partial sale of the firm. Alternative possibilities being examined involve a US initial public offering (IPO) or a partial sale to a private equity firm that would prepare Bet365 for a US IPO, enabling the Coates family to profit in the process.

Speculation about the future of Bet365 in its present state emerged five weeks ago when a research firm from California indicated that the company might go up for auction and could possibly sell for between $10 billion and $12 billion. In March, Bet365 revealed its exit from China, fueling conjecture that the company could be considering a US stock listing or a sale to an American company.

An unnamed source informed The Guardian that Bet365, under the leadership of Denise Coates, may consider a spin-off of a portion of its operations, though specifics regarding how this transaction would unfold are limited at this time. A different unnamed individual familiar with the situation informed the newspaper that the gaming firm is currently engaged in discussions with private equity firms.

How the Bet365 US IPO or Sale Might Unfold

Bet365 has recently introduced online sports betting services in Illinois and Tennessee, and aims to join the launch of the Missouri market later this year. Alongside Illinois and Tennessee, Bet365 can be accessed in Arizona, Colorado, Indiana, Iowa, Louisiana, New Jersey, North Carolina, Ohio, and Virginia. In total, the operator holds roughly 2.5% of the market share in this nation.

That small market share in the US can be viewed from two perspectives. It might deter potential US suitors, suggesting that a request of $10 billion to $12 billion is excessive. Alternatively, it might be viewed as a chance for expansion, especially if Bet365 is acquired by a firm that concentrates solely on the US market.

If Bet365 moves forward with a US IPO at a $12 billion valuation, it would position the operator as the third-largest pure-play iGaming/sports betting stock in the nation, following only FanDuel's parent company Flutter Entertainment (NYSE: FLUT) and DraftKings (NASDAQ: DKNG) in terms of market capitalization.

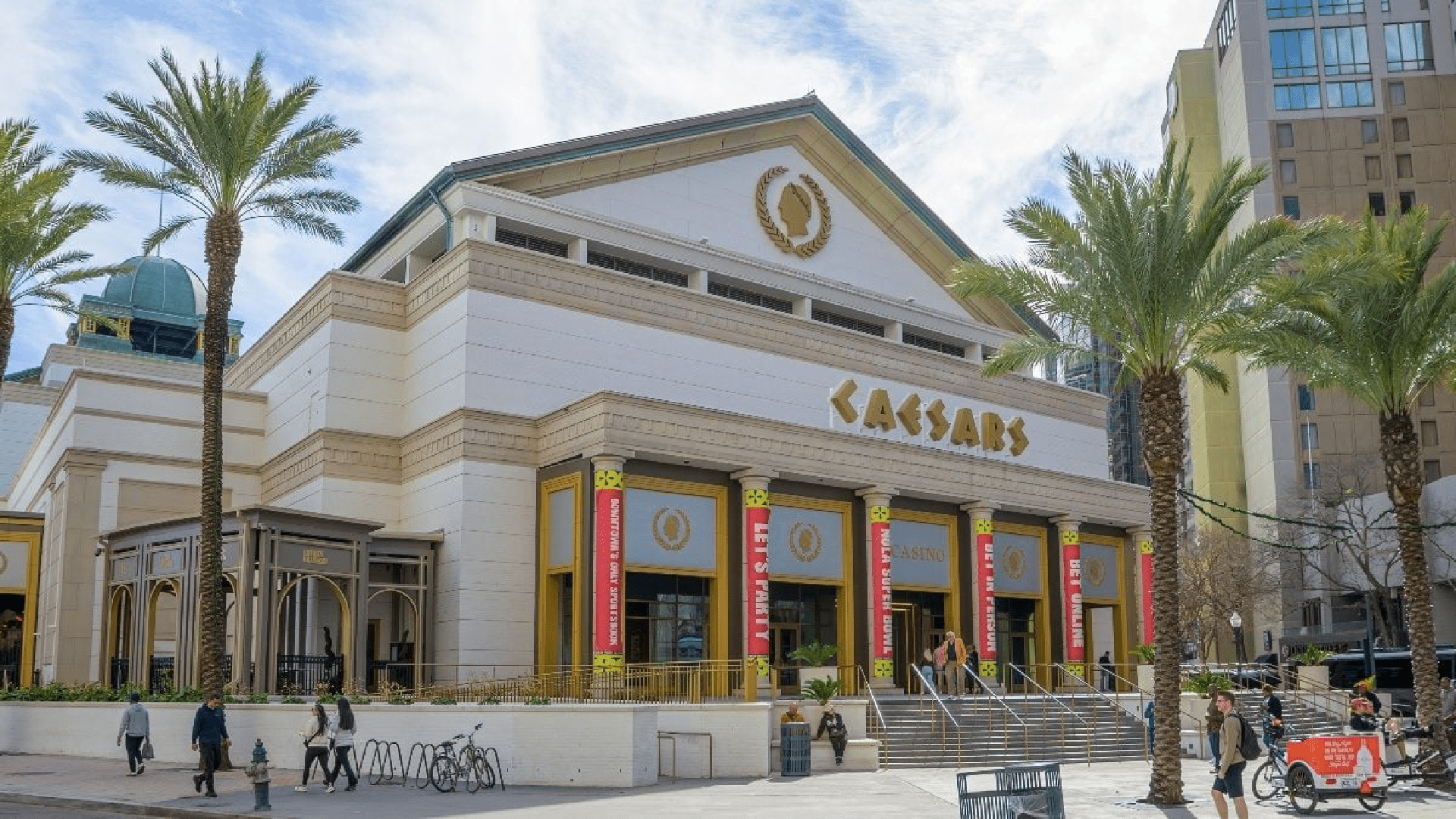

If Bet365 initiated a US IPO with a $10 billion valuation, it would become the fourth-largest gaming stock on the New York Stock Exchange by that measure, ranking behind only Flutter, DraftKings, and Las Vegas Sands (NYSE: LVS), and surpassing prominent casino companies like Caesars Entertainment (NYSE: CZR), MGM Resorts International (NYSE: MGM), and Wynn Resorts (NASDAQ: WYNN).

Possible Candidates for Bet365

UK reports on the Bet365 speculation do not specify which potential buyers might pursue Bet365 if the Coates family decides to sell, yet some familiar private equity players may show interest. While it hasn't expressed a public interest in Bet365, Apollo Global Management (NYSE: APO) has previously made offers for UK-based sportsbook operators and has a substantial history of investing in the gaming sector.

Regarding iGaming and sportsbook operators, Flutter, despite its history of acquisitions, likely isn't a suitable buyer for Bet365 due to considerable overlap in the companies' European operations.

From that point, the pool of gaming-specific prospective buyers for Bet365 narrows significantly since many of these candidates would have to recognize value in the target's ex-US operations, incur debt to carry out a deal, or both.

United Kingdom

United Kingdom

Germany

Germany

Finland

Finland

Norway

Norway

Canada

Canada

Ireland

Ireland